SEO for Insurance Agencies & Agents: The Basics & Beyond

Customer acquisition is vital for insurance companies and individual agents. And the cost of acquiring new customers continues to grow, creeping up to $900 per customer. This […]

Customer acquisition is vital for insurance companies and individual agents. And the cost of acquiring new customers continues to grow, creeping up to $900 per customer. This is where SEO for insurance agencies becomes vital. Search engine optimization brings customers to your website.

While you may know the ins and outs of your industry, understanding how to increase the number of potential customers that see your website can be complicated for non-experts. However, there are plenty of simple techniques almost anyone can implement. For those other SEO techniques, you can hire an SEO service once your site gets off the ground.

The key to improving your SEO is getting started.

By knowing some best practices of SEO and applying them, insurance agents can boost their online visibility and lead generation over time. This article will help you learn the basic techniques then give you some ideas on how you can build on a strong SEO foundation–whether you choose to do so yourself or hire an SEO agency.

How SEO for Insurance Agencies Can Improve Your Business

Search engine optimization (SEO) is a strategic approach to making websites more discoverable by search engines and their users. Through changes to your website, you can gain a higher position among Google’s search results.

The outcome: high web traffic and more potential customers.

While where your website appears in search results seems arbitrary, its effects are clear.

- 75% of searchers never move beyond the first page of desktop search results.

- Over 25% of searchers click through to the first web page result

- 94% of searchers ignore paid Google Ad results

- Over 50% of all website traffic comes from users clicking an organic search result

- Search traffic has increased by 2000% over the past two decades

DIY or Hire an SEO Agency?

While the world of SEO services can be a great resource for businesses, there are some key strategies you can implement to get your website off the ground. By knowing some best practices of SEO and applying them to your niche, insurance agents can boost online visibility and lead generation over time.

To decide whether or not one of our SEO techniques for insurance companies and agents is within your wheelhouse, it’s important to assess your:

- Technical abilities

- Schedule and free time

- Writing capabilities

- Budget

- Staff resources

To make things easier, we assessed each

Most website owners choose a combination of DIY, in-house SEO, and hiring an agency.

Most website owners choose a combination of DIY, in-house SEO, and hiring an agency.

How-to Increase Your Insurance Agency’s Search Visibility

1. Discover and Use Insurance Keywords that Attract Leads

Keywords are the fuel you need to launch your business’s SEO content strategy. By targeting the right keywords on your website, you can boost your visibility in the search engine results and show up more often in front of potential clients.

Insurance agents will need a strong set of industry keywords that reflect the search terms their clients are using.

Keyword research doesn’t need to be difficult. Here’s how to choose and use keywords:

- Start by thinking about who your target client is.

- Then jot down a list of terms they might be searching for when looking for an agent.

For example:

If you’re selling car insurance, some of your target keywords potential customers may use include “auto insurance company near me” and “independent auto insurance agents.”

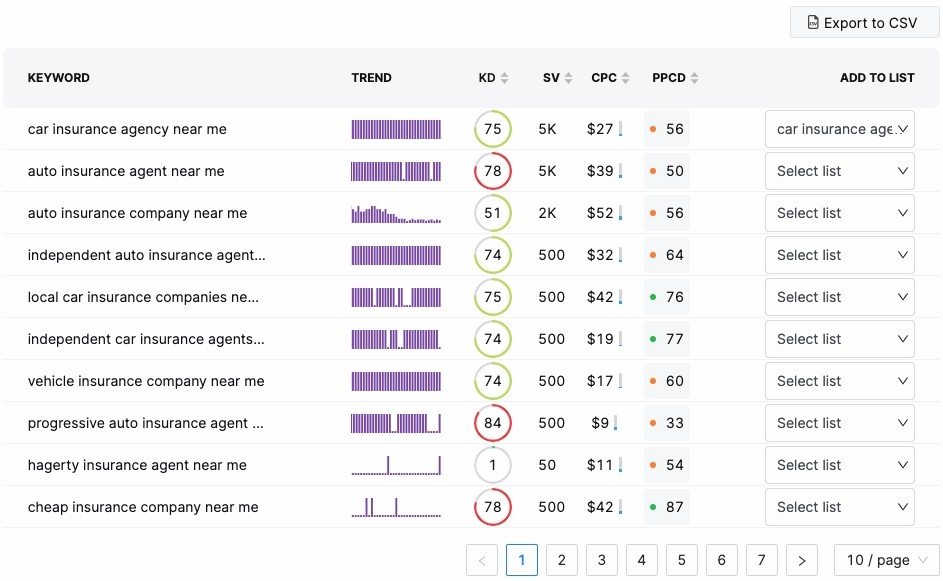

3. Once you have some keywords in mind, you can use a keyword tool to understand how many people are using those terms, how difficult they are to rank for, and what their conversion potential may be.

How to verify your terms and add to them using the Keyword Researcher tool.

a) Prioritize keywords with low keyword difficulty, high search volume, and moderate to high cost-per-click (CPC). Remember to add them to a high-priority list for future reference.

In the above example, “insurance companies near me,” would be a great keyword target for insurance agents or agencies that are attempting to rank in what is a very competitive market.

High search volume shows that searchers are indeed using “companies,” rather than the more common “agencies.”

There is also strong conversion potential (because of the high CPC cost).

b) Use the SERP Overview and Competitor Keyword Grid to analyze how current top search results are implementing your shared keywords.

c) Create a content calendar with blog topics based on your high-priority keyword list.

4. Use the SEO Content Assistant tool to create optimized content.

What Else Do You Need to Know About Insurance Keywords?

Most keyword lists will include what are called long-tail keywords, which are keywords containing three or more words. These keywords help you get closer to your target client.

A long-tail keyword in this niche might look like, “small business health insurance agent,” for example. A specific keyword like this will likely have less competition and be more specific to your target market.

- Technical Skill Level: 3/10

- Writing Skill Level: N/A

- Time Investment: 4/10

2. Set Up a Google Business Profile for Your Insurance Agency

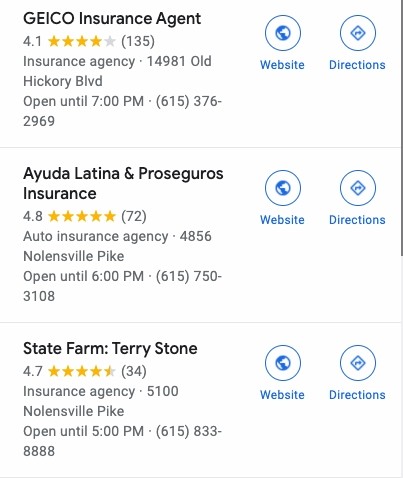

A Google Business (BG) profile (previously known as Google My Business) embeds your business information right into Google’s search results. Putting your info in such a convenient location can yield significant results.

What makes a business profile on Google so effective? Google uses geo-markers to connect searchers with businesses nearby. And these local businesses often appear at the top of the SERP.

- The average business appears in over 1,000 searches monthly.

- As of 2019, 64% of consumers have used Google Business to find a business’ contact information.

- After 2020, Google-listed businesses saw a major increase in calls from their listings.

However, it’s not just about stats.

A detailed GB profile can boost your organic clicks on a local level while making it easier for clients to contact you.

Your Google Business Profile:

After you set up your Google Business account, be sure to include all the information searchers need to find you.

So, what information should you include in your Google My Business profile? Here are some essentials:

- Business name

- Business address

- Website

- Phone number

When you have all of this information filled out, your customers will see your office location on Google maps and clear links to reach you. Another perk? Clients will be able to write reviews on your profile and add images. This can boost business credibility.

- Technical Skill Level: 2/10

- Writing Skill Level: 3/10

- Time Investment: 3/10

3. Optimize your On-Site Content for Local SEO

Local SEO is especially important for insurance agents who primarily serve local markets. With big brands dominating the national landscape, local SEO can help your insurance agency connect with searchers who include geographic language in their queries.

Local SEO is especially important for insurance agents who primarily serve local markets. With big brands dominating the national landscape, local SEO can help your insurance agency connect with searchers who include geographic language in their queries.

By optimizing your on-page content for local search, your agency will get one step closer to boosting leads from local clients.

How to Improve Local SEO for Insurance Agencies:

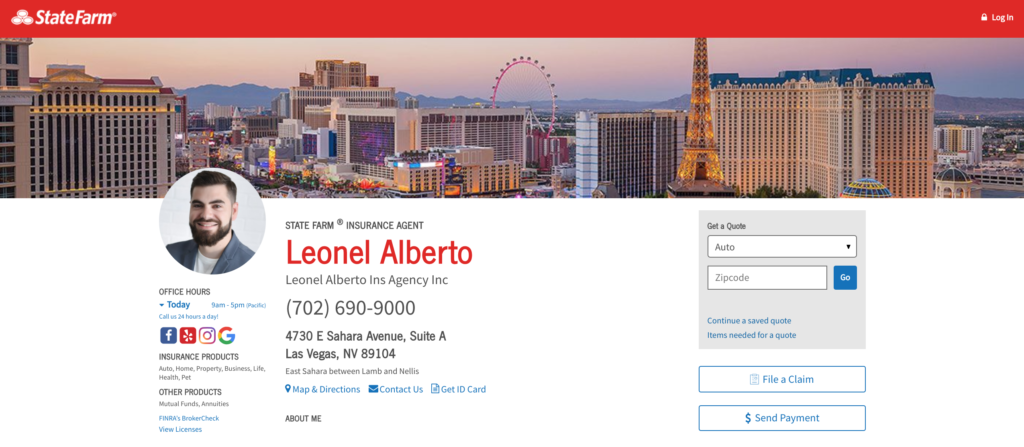

- The first step for optimizing for local SEO is to make sure physical address and contact information is displayed prominently on the web page, like this insurance website does in the below example:

- If your agency covers multiple cities, it can be helpful to create a separate page for each location. You can then optimize each page to reach customers in each geographic area.

This can be easy if you have access to your website builder or content management system (such as WordPress). However, if you use a web developer, you may need to request the change from them.

While there isn’t a one-size-fits-all approach to local SEO, including this element in your overall SEO strategy can help you reach a local audience.

- Technical Skill Level: 6/10

- Writing Skill Level: 5/10 (for multiple location page optimization)

- Time Investment: 3/10

4. Ask Happy Customers to Leave Client Reviews on Major Review Platforms

Referrals and word-of-mouth are often the backbone of local businesses. And with today’s online tools, you don’t need to hand out business cards and hope for recommendations.

Your satisfied customers can leave glowing reviews on platforms like Google Business and Yelp. These reviews can encourage website clicks and boost your online credibility.

So how do you get clients to write these reviews?

There are a few different ways that you can encourage your clients to leave reviews. But one tried and true way is to simply ask.

- If you have a particularly positive experience with a client, reach out to thank them and invite them to write a review. You can also make this an automated part of your follow-up process by including a review request in your follow-up emails.

- And of course, the process doesn’t stop there. Insurance agents need to respond to these reviews once they’re posted.Responding to reviews will show prospective customers that you’re invested in client satisfaction, while showing search engines that you’re an active business.

But what if I get a negative review?

Encouraging happy clients to leave online reviews is a great way to boost online credibility and visibility. But what about negative reviews?

Every business owner knows that the stray negative review is bound to pop up occasionally. And while these reviews can sting, they’re also an opportunity to show your professionalism.

Think of negative reviews as a free PR opportunity. Taking the time to respond and address the issue is a chance to show your customer service skills to prospective clients. A negative review is still an engagement data point and business insight, so be sure to treat it as such.

- Technical Skill Level: 2/10

- Writing Skill Level: N/A

- Time Investment: 3/10

5. Create Blog Content to Leverage your Insurance Industry Expertise

When you’re running a busy insurance agency, keeping up with a blog might be the last thing on your mind. However, your blog is another key aspect of SEO for insurance agents.

There are a few key perks to blogging that insurance agencies should know.

1. Optimize for More Keywords

Every blog post adds another targeted set of keywords to your website. So, you can optimize for more keywords by maintaining your blog over time.

A blog is also a great opportunity to rank for keywords that might be trending in your city or industry at a particular point in time. And remember, you don’t have to write every blog post yourself. Hiring content strategy experts is a great way to outsource high-quality, optimized blog content.

2. Create More Pages for Google to Index

Google indexes every page on your website, so you can show up on search results. Every blog post on your website has a unique URL, so that’s another page to index. Optimizing every aspect of the blog post, including features like the meta description, photo alt text, and headlines are just some of the ways to ensure that the post is ranking and indexed over time

3. Capitalize on Internal Linking

Internal links add zest to your website’s SEO juice, but there’s only so much you can do with website pages alone. That’s why a blog is so effective. You can include several internal links in each blog post, which direct existing and future clients to other pages on your website and boosts page authority.

Overall, blogging is a great way to provide useful information to your clients while supporting your SEO strategy.

You can increase the power of your blog posts by cross-promoting the content on social and taking advantage of guest blogging opportunities. Blogging can be part of a larger internal and back-linking plan that supports your business growth.

- Technical Skill Level: 5/10

- Writing Skill Level: 8/10

- Time Investment: 8/10

6. Launch a Link Building Campaign to Improve the DA of your Insurance Website

Link building is another pillar of good SEO that every insurance business should implement. But what exactly is this strategy?

A Brief Look Into Backlinking

The goal of a link building campaign is to increase the number of links to your website. These links are called “backlinks.”

By peppering backlinks across the web, you can increase your site’s domain rating (or DR for short). Your DR is basically a score that indicates how likely your site is to rank in search engine results.

Backlinks also bring in organic traffic and improve overall search rankings.

When launching a link building campaign, your objective will be to get pieces of content, called “assets,” published on websites around the internet. Guest blogs are a popular example of assets and can be a highly effective link building method for insurance agents.

The basic steps that you can expect during the link building process:

1. Asset Creation

Before you can get started on a robust backlink profile, you need to create your first asset. In your case, this could be a stellar piece of blog content that’s relevant to the insurance industry.

You should add a link to your website to relevant anchor text. Since you want industry websites to publish your content, be sure that the blog post is well researched, well written, and provides useful information to your target audience.

2. Pitching

Once you have a flawless piece of link-building content in your hands, it’s time to pitch it to industry websites.

Remember, websites with higher domain ratings are more likely to boost your rankings. Try to personalize your pitches as much as possible and be clear about why your content provides value. While you might not earn a placement on every site you pitch to, the first few placements can launch your campaign.

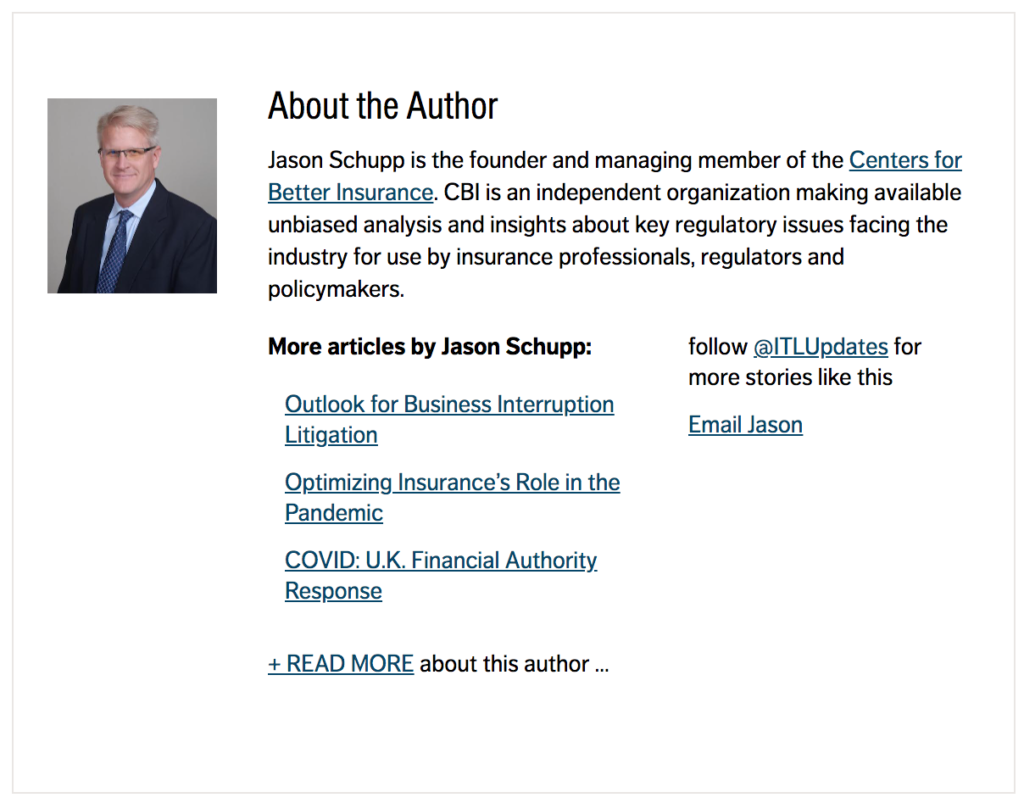

3. Guest Blogging

Guest blogging provides you the opportunity to create an informative, useful piece of content for another webmaster in exchange for a link to your website. That link can either be in the article (linking back to an informative article on your own site) or in your writer bio.

Guest blogging provides you the opportunity to create an informative, useful piece of content for another webmaster in exchange for a link to your website. That link can either be in the article (linking back to an informative article on your own site) or in your writer bio.

The reality is that contributing thought leadership takes time and hard work, but it can bring loads of value to your backlink profile and improve your SEO rankings by building your site authority in the long-term.

- Technical Skill Level: 2/10

- Writing Skill Level: 8/10

- Time Investment: 9/10

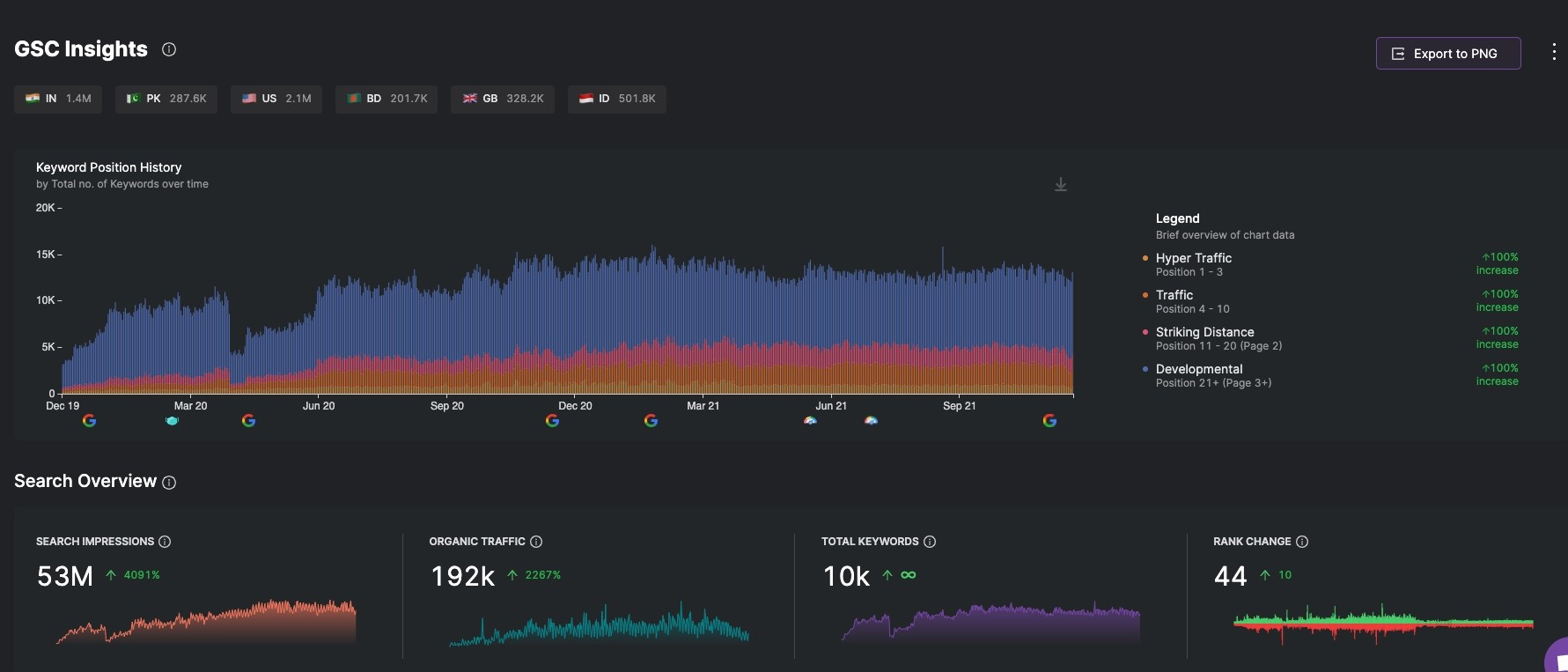

7. Monitor your Search Results Using Google Search Console or GSC Insights

You created a website for your insurance agency, optimized it using keywords, set up a blog, and started a link building campaign.

But how do you know if your efforts are working? This is where learning how to use Google Search Console comes in.

How to Use Google Search Console to Boost SEO for Insurance Agencies

Once you set up your account and prove ownership of your domain, this platform allows businesses to monitor their search results, ranking data, and user behavior.

You can also receive alerts about errors on your site, so you can address issues quickly. And above all, businesses can confirm that Google has located, crawled, and index their site.

To break it down, even more, Google Search Console allows users to monitor:

- Indexed links

- Search appearances

- Position value

- Impressions

- Clicks

- Click-through rate (CTR)

- Referring domains

- Domain rating

- Security problems

- HTML errors

And this is only a handful of the information you can gain from this platform. By monitoring Google Search Console consistently, you can learn which aspects of your SEO strategy are working and which might need tweaking.

- Technical Skill Level: 6/10

- Writing Skill Level: N/A

- Time Investment: 6/10

Using GSC Insights to Track SEO Performance

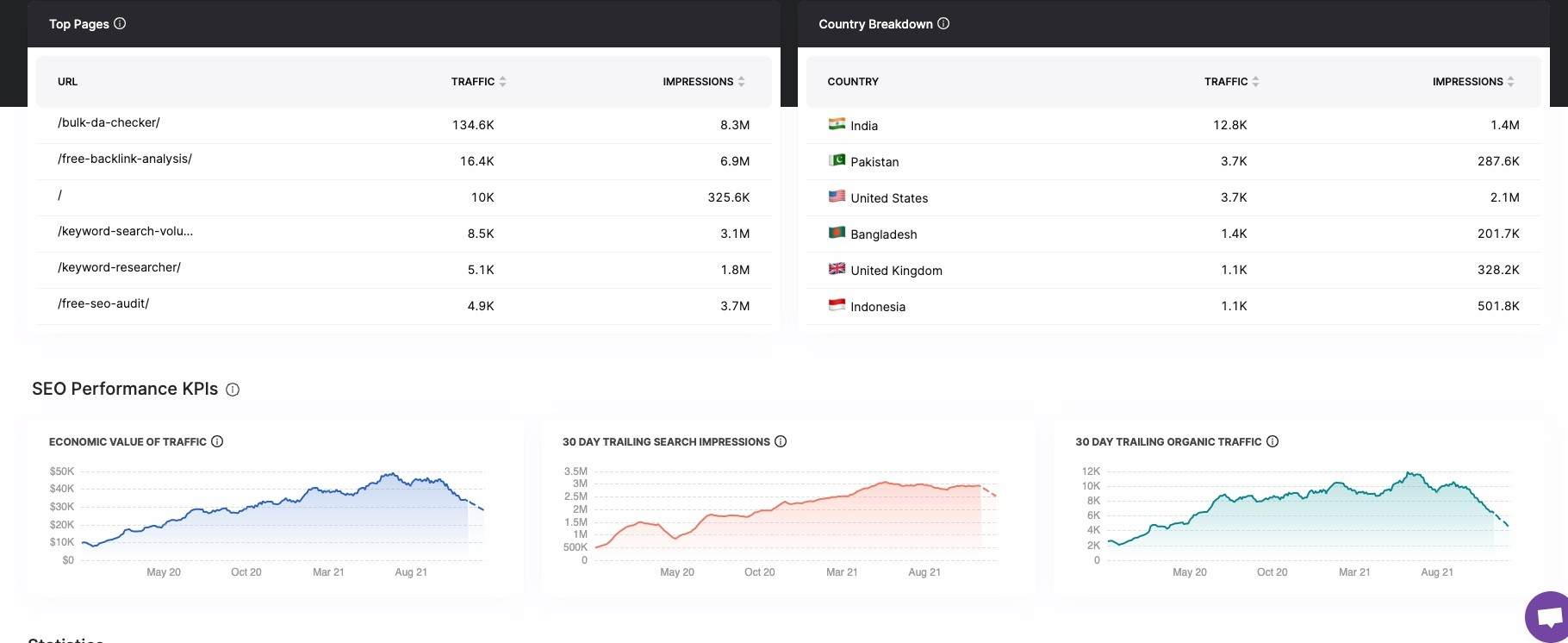

GSC Insights is another Search Atlas SEO software that allows users to visualize and monitor the results of their SEO efforts easily with:

An easy-to-read overview of your SEO performance

Top page data, web traffic by region, and SEO KPIs

Along with site visibility reports, overall rank change data, and more

- Technical Skill Level: 2/10

- Writing Skill Level: N/A

- Time Investment: 4/10

Team up with an SEO Agency that Understands the Insurance Industry

If this list makes your head spin, you’re not alone. Busy insurance agents may have trouble finding the time to manage their SEO strategy. This is why many agents will hire an SEO agency to implement a strategy for them.

However, you need to do your research and choose wisely.

Why? All SEO agencies aren’t created equal. An SEO agency without insurance knowledge might not have the experience necessary to drive an effective SEO strategy. You want to choose an experienced SEO agency that understands the insurance industry and your unique goals as an agency.

When searching for an SEO agency, there are a few key questions you should ask.

Q: Have You Worked With Other Insurance Agencies?

While the general principles of SEO apply across most industries, each industry also has its own best practices. Choosing an SEO agency that has experience working with insurance agents means that the experts have performed industry-specific keyword research, onsite optimization, and link building.

Q: Can You Show Results?

If you find an SEO agency that has experience working with insurance agents, be sure to ask for results. The agency should be able to show their success rate with past clients, such as cutting cost-per-lead metrics. See our health insurance company SEO case study for an example of what improved metrics and rankings can look like when teaming up with the right SEO partner.

Q: How Can Your Services Support My Business Goals?

Most SEO agencies will offer a consultation to discuss their services, as well as your business goals. Don’t be afraid to get specific during this conversation. Ask which services would best apply to your business needs and what approach they would take to deliver results.

Invest in SEO. Invest in Your Agency’s Future.

In a world where 8 out of 10 customers Google businesses before contacting them, SEO is essential for survival. Furthermore investing in becoming more discoverable by people looking for an insurance business just like yours offers a phenomenal return on investment.

Whether you tackle the SERPs yourself or use an agency, keep in mind that SEO is more like a marathon than a sprint. So, you should expect slow steady gains. If you’re using an agency anticipate a long-term partnership. This makes it all the more essential to choose an agency that has experience in the insurance industry and puts your goals at the center. Once you find the right fit, you can launch a strategy and watch your lead generation improve over time.